Starting January 1, 2026, Nigerians and foreigners will not be able to open or operate a bank account without a Tax Identification Number (Tax ID).

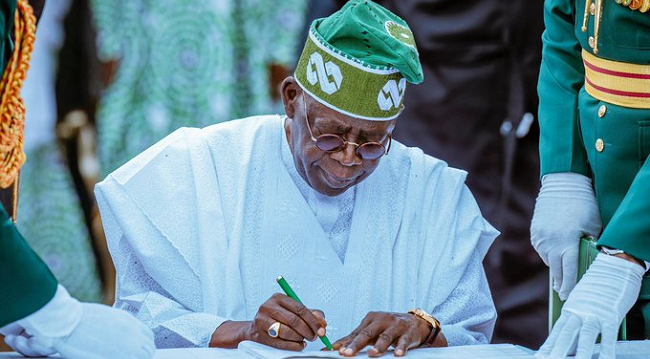

The rule, part of the Nigeria Tax Administration Act, 2025 signed by President Bola Tinubu, also makes a Tax ID mandatory for insurance policies, stock market dealings, and government contracts.

The law requires all taxable persons and businesses to register for a Tax ID. MDAs across federal, state, and local levels must also comply, while non-residents providing taxable goods or services in Nigeria will be compelled to register and pay tax.

Tax authorities will have powers to automatically issue or decline Tax IDs within five days, while businesses shutting down must notify authorities within 30 days to deregister.

The Act also creates the Nigeria Revenue Service, to be funded with 4% of revenues collected, excluding petroleum royalties. Its Executive Chairman will serve a renewable four-year term.